BOSTON SCIENTIFIC (BSX)·Q4 2025 Earnings Summary

Boston Scientific Beats on EPS and Revenue, but Stock Falls 8% After Hours on 2026 Guidance

February 4, 2026 · by Fintool AI Agent

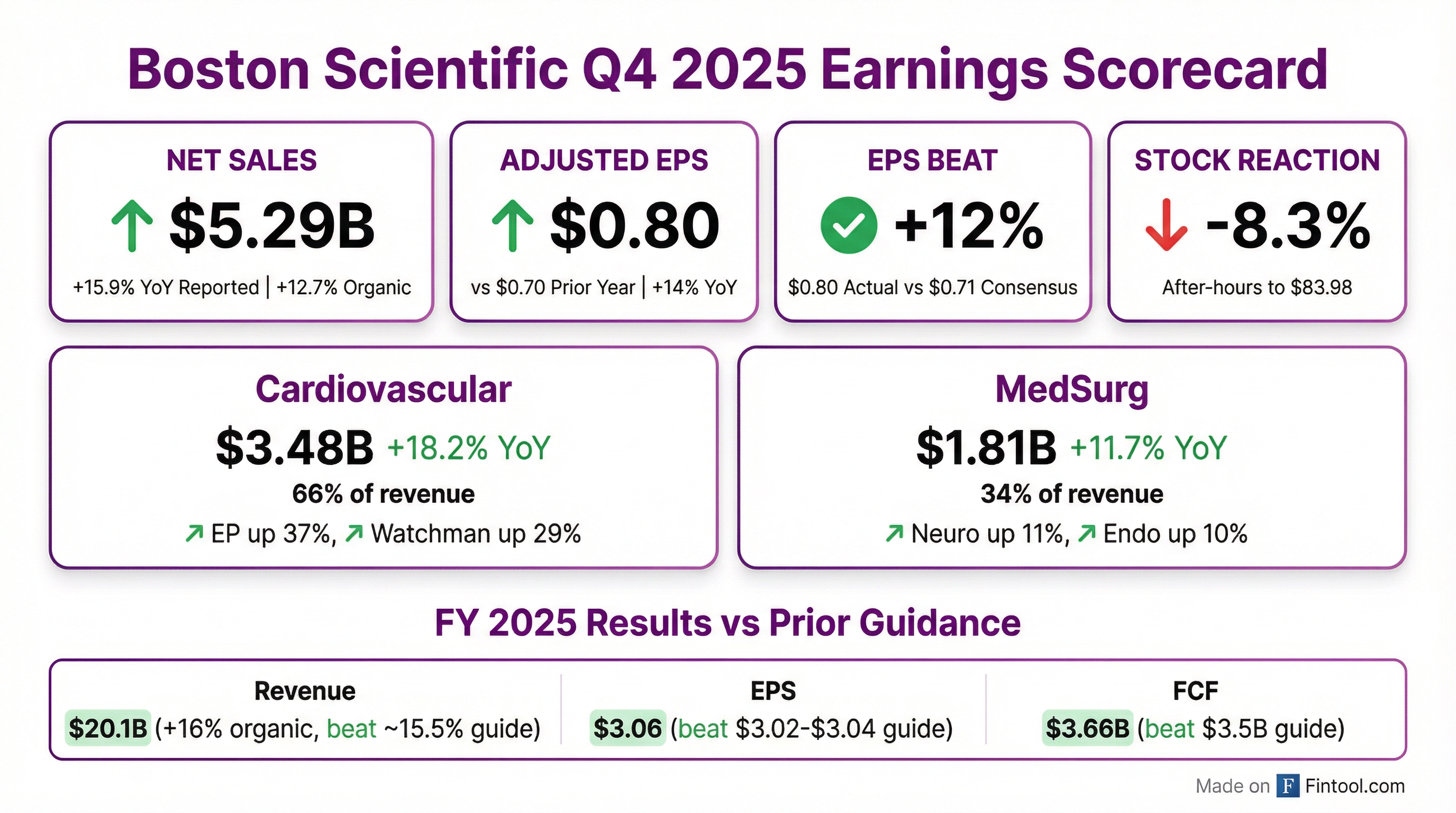

Boston Scientific delivered a strong Q4 2025, with revenue of $5.29 billion (+15.9% YoY reported, +12.7% organic) and adjusted EPS of $0.80 (+14% YoY), both exceeding consensus estimates. The Cardiovascular segment continued its dominance, with Electrophysiology surging 37% and Watchman growing 29% as concomitant procedures become standard of care. However, shares dropped approximately 8% in after-hours trading to $83.98 after FY 2026 guidance of 10-11% organic growth signaled deceleration from FY 2025's exceptional 16% pace.

Did Boston Scientific Beat Earnings?

Yes — BSX beat on both top and bottom line, and exceeded prior guidance.

The company also exceeded its full-year 2025 guidance:

This marks the 9th consecutive quarter of Boston Scientific beating EPS estimates, demonstrating exceptional execution across its diversified medtech portfolio.

What Were the Key Revenue Drivers?

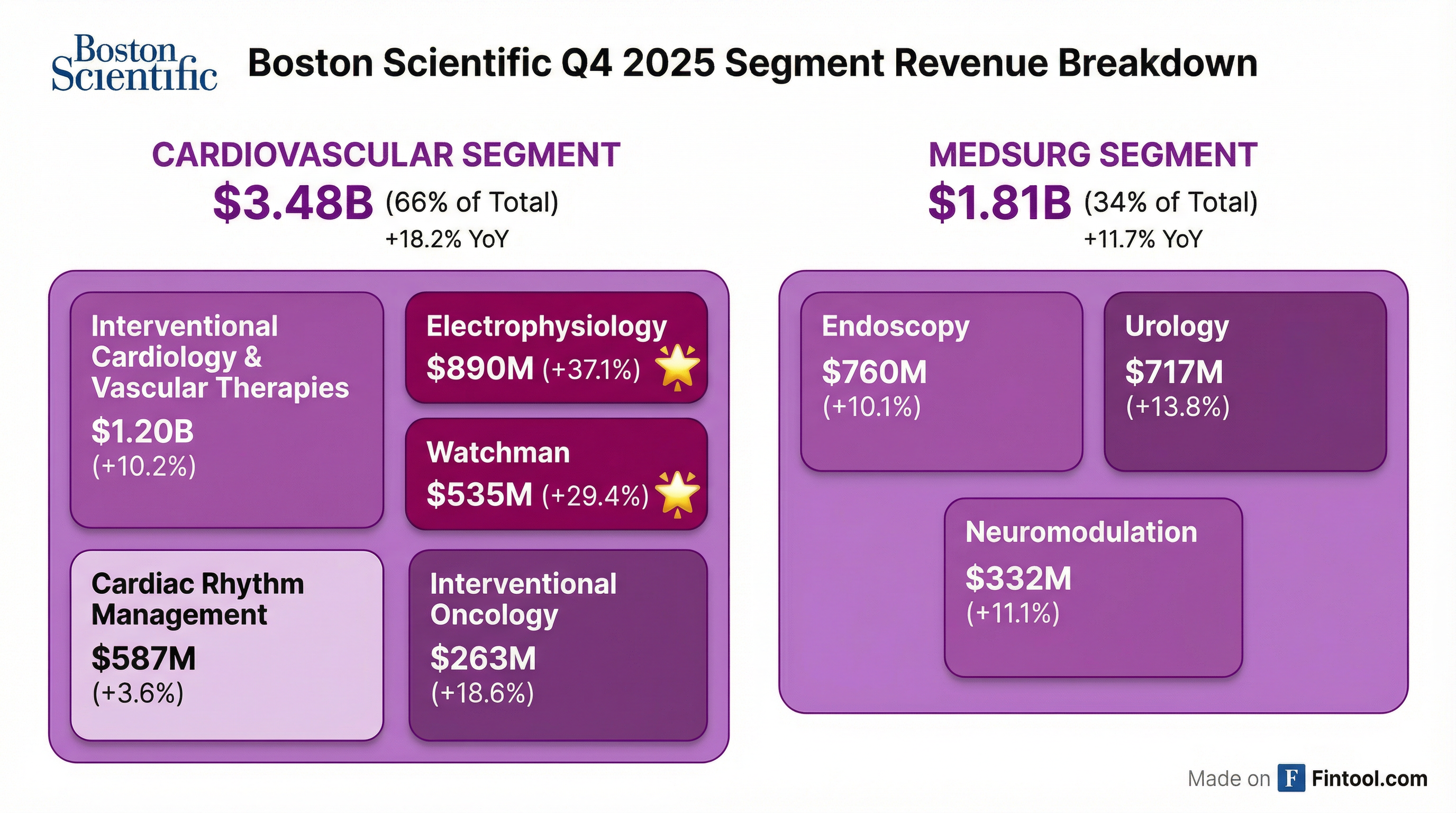

Cardiovascular was the standout, growing 18.2% and representing 66% of total revenue. The two star performers:

Electrophysiology (+37.1% reported, +35.1% organic): FARAPULSE continues its dominance in the pulsed field ablation (PFA) market. Full-year EP revenue of $3.33B represents 73% organic growth, with over 500,000 patients treated. The integration of OPAL mapping and FARAWAVE NAV catheter is driving strong utilization. The company received FDA approval and CE mark for the FARAPOINT focal PFA catheter.

Watchman (+29.4% reported): The LAAC franchise delivered $535M in Q4, driven by accelerating concomitant procedure adoption (Farapulse + Watchman). Full-year Watchman revenue reached $1.96B. The company has now treated more than 25,000 patients concomitantly with Watchman. Management expects concomitant procedures to reach 25% of U.S. Watchman volume exiting 2025, with potential to double by 2028.

Segment Performance Summary

Urology underperformed with 3.2% organic growth (13.8% reported including Axonics), impacted by supply chain issues and low-cost competition. Management acknowledged performance was "below expectations" but expects the business to return to market growth in 2026 with supply chain issues resolved and new product launches.

Regional Performance

China update: Received NMPA approval for FerroAVE Nav device and indication expansion into persistent AF population, positioning for continued EP momentum.

What Did Management Guide for FY 2026?

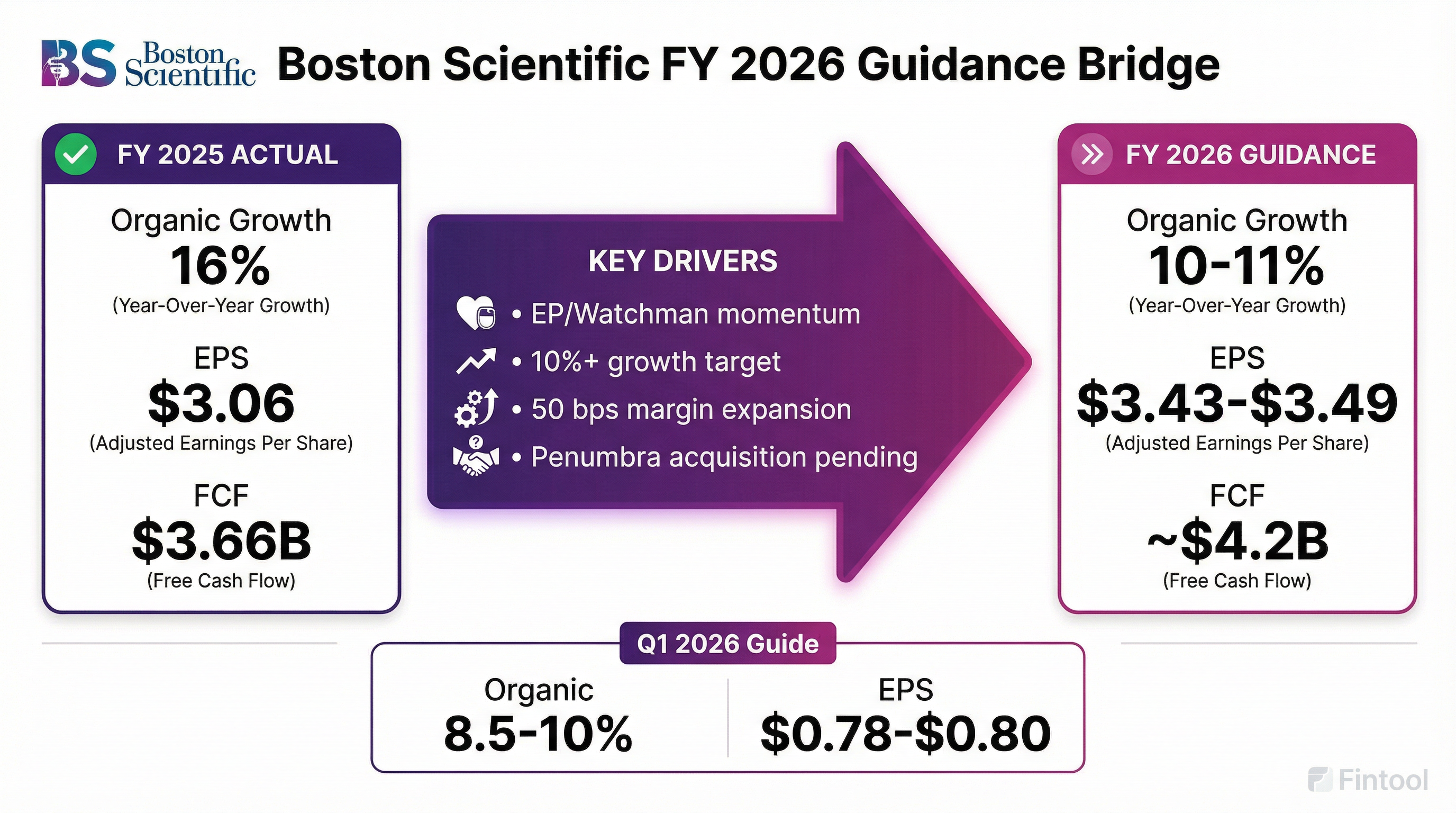

Boston Scientific introduced FY 2026 guidance that implies meaningful deceleration from FY 2025's exceptional performance:

Q1 2026 Guidance:

- Reported net sales growth: 10.5-12.0%

- Organic net sales growth: 8.5-10.0%

- Adjusted EPS: $0.78-$0.80

- Adjusted tax rate: ~12%

The Q1 2026 organic growth guidance of 8.5-10.0% includes approximately 150 basis points of headwind from two transient issues:

- Acclarent discontinuation: The company discontinued this ENT product line, creating a comparison headwind

- Axios device withdrawal: Certain sizes of the Axios stent device were removed due to a manufacturing variation; expected to return to full market by mid-year

Both issues are expected to annualize by Q2/Q3 2026, supporting acceleration in the second half.

Why the FY 2026 deceleration? Several factors drive the step-down:

- EP comps normalize: FY 2025's 73% EP growth creates tough comparisons

- FX headwinds: Guidance assumes 50 bps FX headwind (vs. 100 bps tailwind in FY 2025)

- Pending M&A exclusion: Guidance excludes the announced Penumbra acquisition

How Did the Stock React?

Despite beating Q4 2025 estimates and exceeding FY 2025 guidance across all metrics, BSX shares fell approximately 8% in after-hours trading to $83.98 from the $91.62 close.

The selloff appears driven by:

-

Deceleration concerns: FY 2026 organic growth guidance of 10-11% represents a significant step-down from FY 2025's 16% pace, even though it remains well above medtech peers

-

Elevated expectations: The stock had risen significantly, trading at ~37x forward earnings ahead of the print

-

Penumbra acquisition uncertainty: The pending $8.5B acquisition of Penumbra adds integration risk and was excluded from guidance

-

Urology weakness: Below-expectation performance in the Axonics integration raises execution questions

It's worth noting that BSX consistently under-promises and over-delivers — the company has beaten estimates for 9 consecutive quarters and initially guided FY 2025 organic growth of 10-12% before delivering 16%.

What Did Management Say on the Call?

The Q&A session revealed important context around EP market dynamics and upcoming catalysts:

On EP Market Growth (Mike Mahoney, CEO):

"We think the market in Q4 was closer to 18%-20% growth rather than what some other companies have claimed at 25%. So we think the market was kind of 18%-20% range... and we've called the market for 2026 at about 15% growth."

Management pushed back on competitor claims of 25% EP market growth, arguing the true market is 18-20%. Despite this, BSX's 35% EP growth significantly outpaced peers (6.5% for the market leader, 12.5% for the third-place player).

On PFA Market Share:

"As we exit 2025, we're kind of in a 65-ish% PFA market share position... Our PFA share will reduce somewhat, but we're very confident by year-end, likely, if you add all the other competitors together, our share will be equal to them or in that area."

On US PFA Penetration (Dr. Ken Stein, CMO):

"I think US PFA penetration is already at 70% for AF cases... 30% left to penetrate."

The 70% US PFA penetration suggests the market is in later innings of the AFib mix shift. Management sees VT ablation and focal lesion procedures as the next growth frontiers.

On Champion Trial Endpoints:

"There are two co-primary endpoints. One, non-inferiority for a combined endpoint stroke, systemic embolism, and death. One, for bleeding... The bleeding endpoint is powered as a superiority endpoint."

Dr. Stein confirmed the bleeding endpoint is powered for superiority, not just non-inferiority. A positive result could expand the addressable patient population from ~5 million to 20 million globally.

On Recent Watchman Trial Concerns:

"Can very without any equivocation say that we have not seen any impact from those trials, Closure alone, AF and Ocean. And again, we continue to see very robust uptake of Watchman in general and of concomitant procedures, specifically."

On Capacity Constraints:

"The keys to driving [growth] forward will be, A, starting the build-out of ASCs in the United States to unlock some more capacity and reduce those waiting lists. Continued just development and repurposing cath labs for the use for EP procedures in the hospital."

Upcoming Catalysts from Q&A

Two major late-breaker presentations at ACC (Saturday, March 28, 2026):

- CHAMPION Trial: Watchman vs. novel oral anticoagulants for stroke prevention (investor event at 5:30 PM Central)

- HI-PEITHO Trial: EKOS vs. standard of care anticoagulants for PE

What Changed From Last Quarter?

Key changes vs. Q3 2025:

Operational highlights this quarter:

- SEISMIQ IVL System: Initiated U.S. launch for peripheral artery disease

- FARAPOINT PFA Catheter: Received FDA approval and CE mark

- TheraSphere 360 Platform: FDA 510(k) clearance for liver cancer treatment

- SIMPLAAFY trial: Completed enrollment studying post-Watchman antiplatelet therapy

- FRACTURE IDE trial: Completed enrollment for coronary IVL

- Nalu Medical acquisition closed: Expands pain neuromodulation portfolio

- Penumbra acquisition announced: $8.5B deal for thrombectomy and neurovascular solutions

What Are the Key Risks?

-

EP market growth normalization: Management guided to 15% EP market growth in 2026, down from what they estimate was 18-20% in Q4 2025. With US PFA penetration at ~70%, the efficiency gains that drove rapid growth are now "largely built into the system."

-

PFA share loss: BSX entered 2026 with ~65% PFA share but expects competitors (combined) to approach parity by year-end. Management acknowledged "with new entrants coming, it's not surprising that we lost some share."

-

Capacity constraints: EP labs face growing wait lists. ASC buildout and cath lab repurposing will take time to unlock capacity.

-

Penumbra integration: The $8.5B acquisition represents significant execution risk; all three rating agencies affirmed A- equivalent rating, with Fitch upgrading outlook to positive. Gross leverage at 1.9x.

-

Urology turnaround: Axonics integration challenges and supply chain issues need resolution. Management expects return to market growth in 2026.

-

Transient headwinds: Axios device withdrawal (manufacturing variation) and Acclarent discontinuation create ~150 bps headwind in H1 2026.

Forward Catalysts

Near-term (Q1-Q2 2026):

- ACC Late Breakers (March 28, 2026):

- CHAMPION Trial: First-line Watchman vs. NOACs for stroke prevention (investor event 5:30 PM CT)

- HI-PEITHO Trial: EKOS vs. standard anticoagulants for pulmonary embolism

- FRACTURE trial results for coronary IVL — enrollment completed

- SIMPLIFY trial data (post-Watchman antiplatelet therapy) — H2 2026

- Valencia Technologies acquisition closing (pelvic health, H1 2026)

- Penumbra acquisition closing (2026)

- Axios device return to full market (mid-2026)

Medium-term (2026-2027):

- SEISMIQ IVL coronary indication (first half 2027)

- REMATCH AF trial data (redo AF ablations with Farapulse) — 2027

- OPTIMIZED trial (Cortex OptiSnap mapping with Farapulse) — initiated

- SYNCHRONICITY trial (left bundle branch pacing vs. CRT) — enrollment started

- Siemens 4D ICE catheter partnership (AccuNav) — in development

- ASC buildout for AF ablation procedures

Long-range plan targets (through 2028):

- 10%+ average organic revenue growth

- 150 bps cumulative operating margin expansion

- Leveraged double-digit EPS growth

- 70-80% annual FCF conversion

The Bottom Line

Boston Scientific delivered another strong quarter, beating estimates across the board and demonstrating the power of its diversified medtech portfolio. The Electrophysiology and Watchman franchises continue to be exceptional growth engines, and the company's execution remains best-in-class.

The after-hours selloff appears to be a "sell the news" reaction to FY 2026 guidance that implies normalization from FY 2025's exceptional pace. However, 10-11% organic growth and 12-14% EPS growth still represent differentiated performance vs. medtech peers. The key debates for investors:

- Can management continue its track record of beating guidance?

- How quickly will EP growth normalize as PFA penetration matures?

- Will the Penumbra acquisition prove accretive or create integration risk?

- Can Urology execution improve with Axonics integration?

The company's long-term thesis remains intact: a diversified portfolio of category-leading franchises, strong pipeline execution, and disciplined capital allocation. The stock's reaction may present an opportunity for long-term investors who believe management will continue to under-promise and over-deliver.

Data sources: Boston Scientific Q4 2025 Earnings Call Transcript, Q4 2025 Earnings Slides, Q3 2025 Earnings Call Transcript, S&P Global estimates

For the full earnings call transcript, see BSX Q4 2025 Transcript